Per Diem is a payment to an employee under an accountable expense reimbursement allowance that is:

- Paid for business expenses the employer reasonably anticipates will be incurred by an employee for travel away from home for Meals and incidental Expenses

- A fixed amount is awarded instead of reimbursing actual meals and incidental expenses with no receipts required.

- All amounts paid under an accountable plan are: Tax free, are not reported on Form W-2 and are not subject to income or employment taxes

- Anyone who travels out of town overnight for work is allowed to claim per diem.

- A driver must be working away from home for at least 12 hours. This refers to the day a driver starts and ends their travel.

- Within a reasonable amount of time the driver must substantiate “Time, Date, and Place,” business connection and purpose of travel. A drivers HOS log provides the required substantiation.

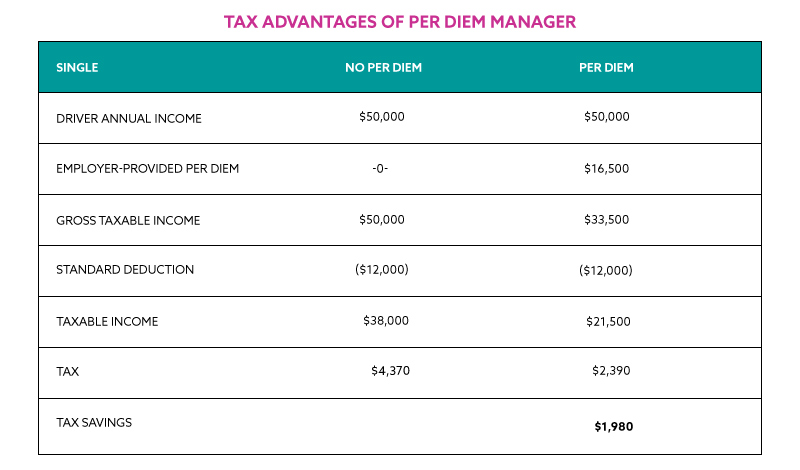

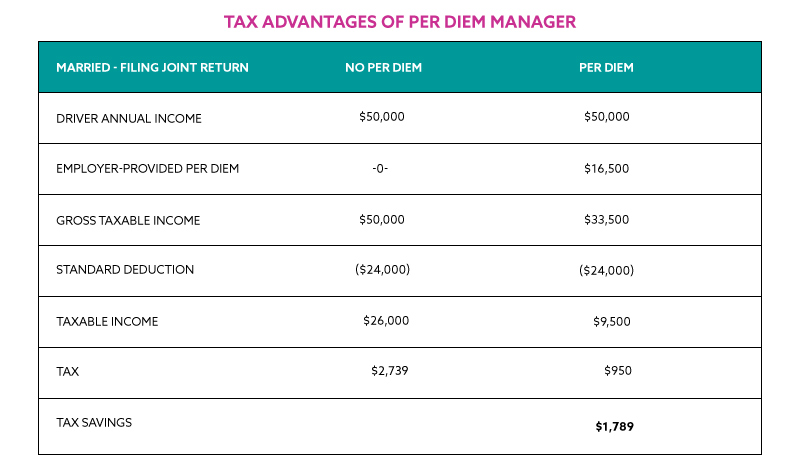

New tax laws in 2018 brought changes to Per Diem which all drivers should be aware of:

- company drivers are no longer allowed to deduct Per Diem as an itemized deduction when filing their year end taxes.

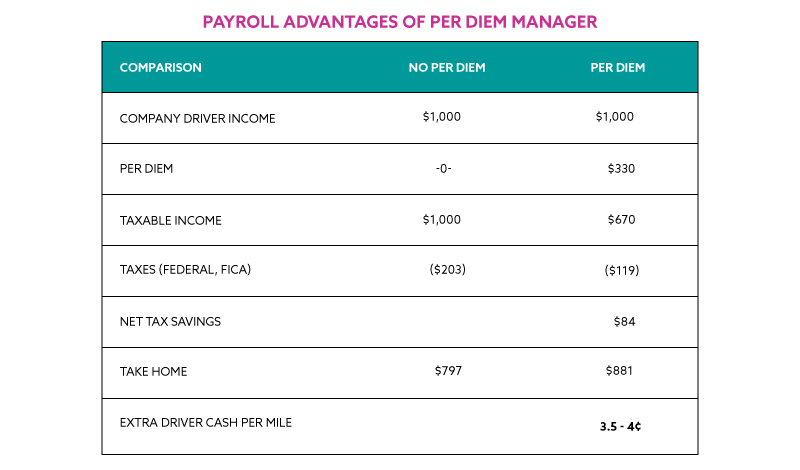

- Only drivers who participate in a company sponsored program, like Omnitracs Per Diem Manager, can take advantage of the substantial tax benefits that come with Per Diem.

Things to Remember:

- A driver who is out of town overnight may receive one $66 meals & incidental expense reimbursement up to 7 times per week.

- A driver must depart for an overnight trip before 12:00 noon to be awarded Per Diem on the first day away from home, and return home after noon to be awarded Per Diem on the last day away from home.

- Per Diem is awarded when traveling a least 25 miles away from your tax home zip code.

- IRS-required “Time, Date and Place” substantiation is retained and accessible to a driver for 7 years.

- Per Diem Manager is provided as a benefit to company drivers at no cost to the driver.

- Owner Operators per diem is not calculated in payroll. It is compiled for an end of year reporting.